See Terms of Use for more information. Fundamentals Level Skills Module Paper F6 MYS SeptemberDecember 2017 Sample Answers Taxation Malaysia and Marking Scheme Section B Marks 1 aDelia Spa Sdn Bhd.

Accelerated capital allowance ACA for the purchase of machinery and equipment.

. Example 8 amended on 12072017. 8 June 2017 Page 1 of 24 1. 27 August 2015.

Used motor vehicle which cost less than RM50000 the qualifying expenditure is. 62015 Date Of Publication. In the 2020 Economic Stimulus Package announced on 27 February 2020 it was.

Qualifying expenditure for private motor vehicles. Unabsorbed capital allowances can be carried forward indefinitely to be utilised against income from the same business source. CLAIMING ALLOWANCES Public Ruling No.

Year of Assessment 2017. The aca rules was gazetted on 5 july 2018 and is effective from year of assessment ya 2017. One of these deductions is the capital allowances in Malaysia.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited DTTL its global network of member firms. 72018 Date Of Publication. The 20000 will be eligible for the annual investment allowance.

8 Oktober 2018 INLAND REVENUE BOARD OF MALAYSIA _____ Page 2 of 19 43 The conditions that must be fulfilled by a person to. 22017 Date of Publication. Home Capital Allowance Malaysia 2017.

The cost of purchasing capital equipment in a business is not a revenue tax deductible expense. Objective The objective of this Public Ruling PR is to explain. - cost of assets used in a business such as plant and machinery office equipment furniture and fittings motor vehicles etc.

1 January 2015 to 31 December 2020. Income Tax Accelerated Capital Allowance Automation Equipment 2017 Amendment Rules 2020 Income Tax Exemption No8 2017 Amendment Order 2020 Why Malaysia. These proposals will not become.

We can simplify it by splitting it into 4 categories. INLAND REVENUE BOARD OF MALAYSIA COMPUTATION OF CAPITAL ALLOWANCES Public Ruling No. Income Tax Accelerated Capital Allowance Automation Equipment Rules 2017.

1 January 2015 to 31 December 2017. The GST treatment on. Qualifying expenditure QE QE includes.

Inland Revenue Board of Malaysia. Capital allowances in Malaysia are therefore deductible expenses. On 30 August 2017 two orders PU.

Encik borhan is the owner of a construction supplies business. Qualifying Expenditure For Purposes Of Claiming Allowances. Income tax accelerated capital allowance automation equipment 2017 amendment rules 2020 pu.

This booklet incorporates in coloured italics the 2017 Malaysian Budget proposals announced on 21 October 2016. Business loss for the year of assessment 2016 capital allowances bf and current year capital allowances on other assets were RM160000 RM30000 and RM55000 respectively. A 2532017 that are effective as from year of assessment 2015 were published in Malaysias federal gazette to provide.

52014 dated 27 June 2014 -. Capital allowances specifically are capital purchases like the acquisition of land and building that can be claimed. A 2522017 and PU.

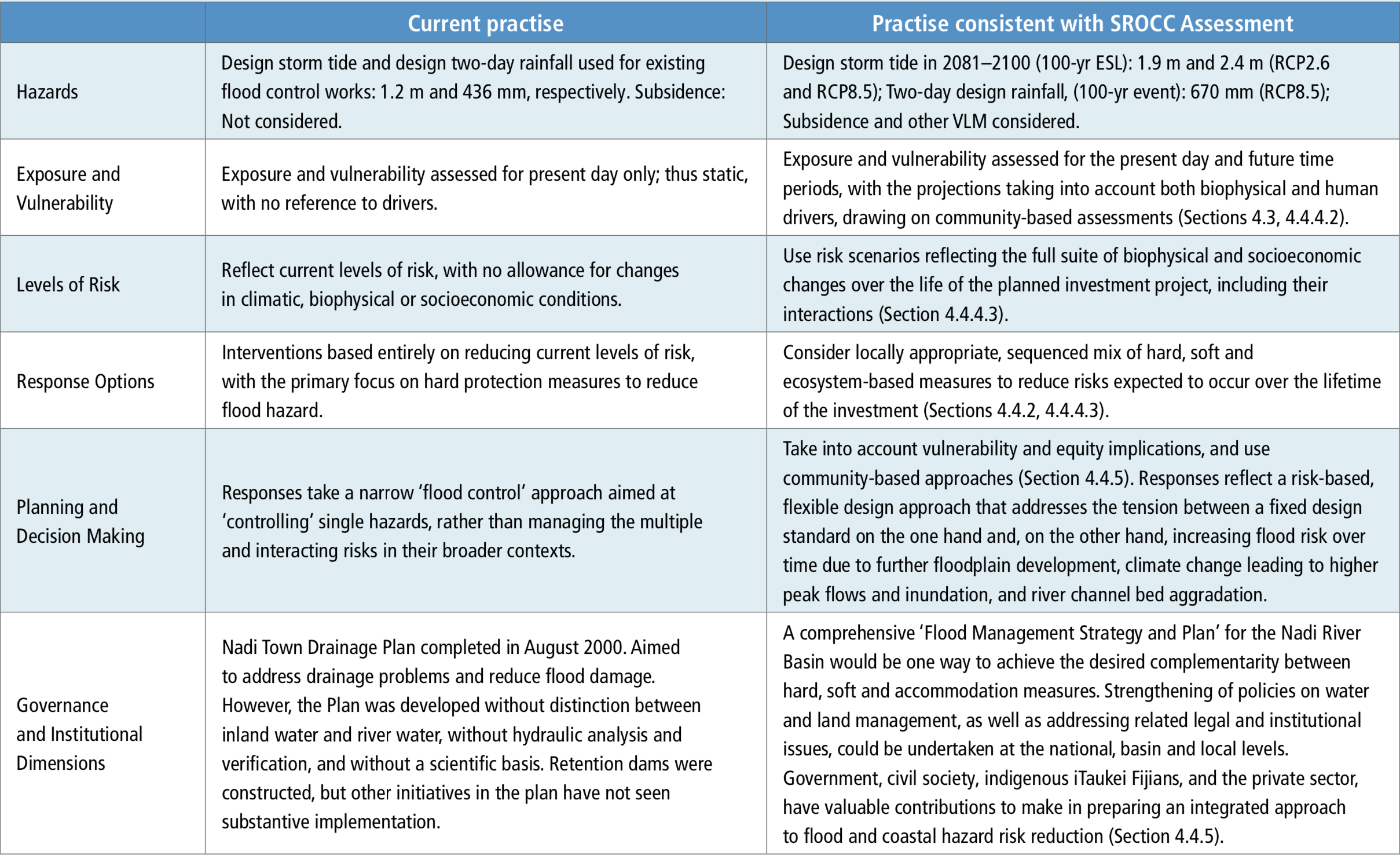

Chapter 4 Sea Level Rise And Implications For Low Lying Islands Coasts And Communities Special Report On The Ocean And Cryosphere In A Changing Climate

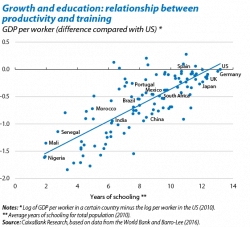

Key Policy Insights Oecd Economic Surveys Estonia 2019 Oecd Ilibrary

Financial Statements 2020 Knowledge Base

Key Policy Insights Oecd Economic Surveys Switzerland 2019 Oecd Ilibrary

Key Policy Insights Oecd Economic Surveys Estonia 2019 Oecd Ilibrary

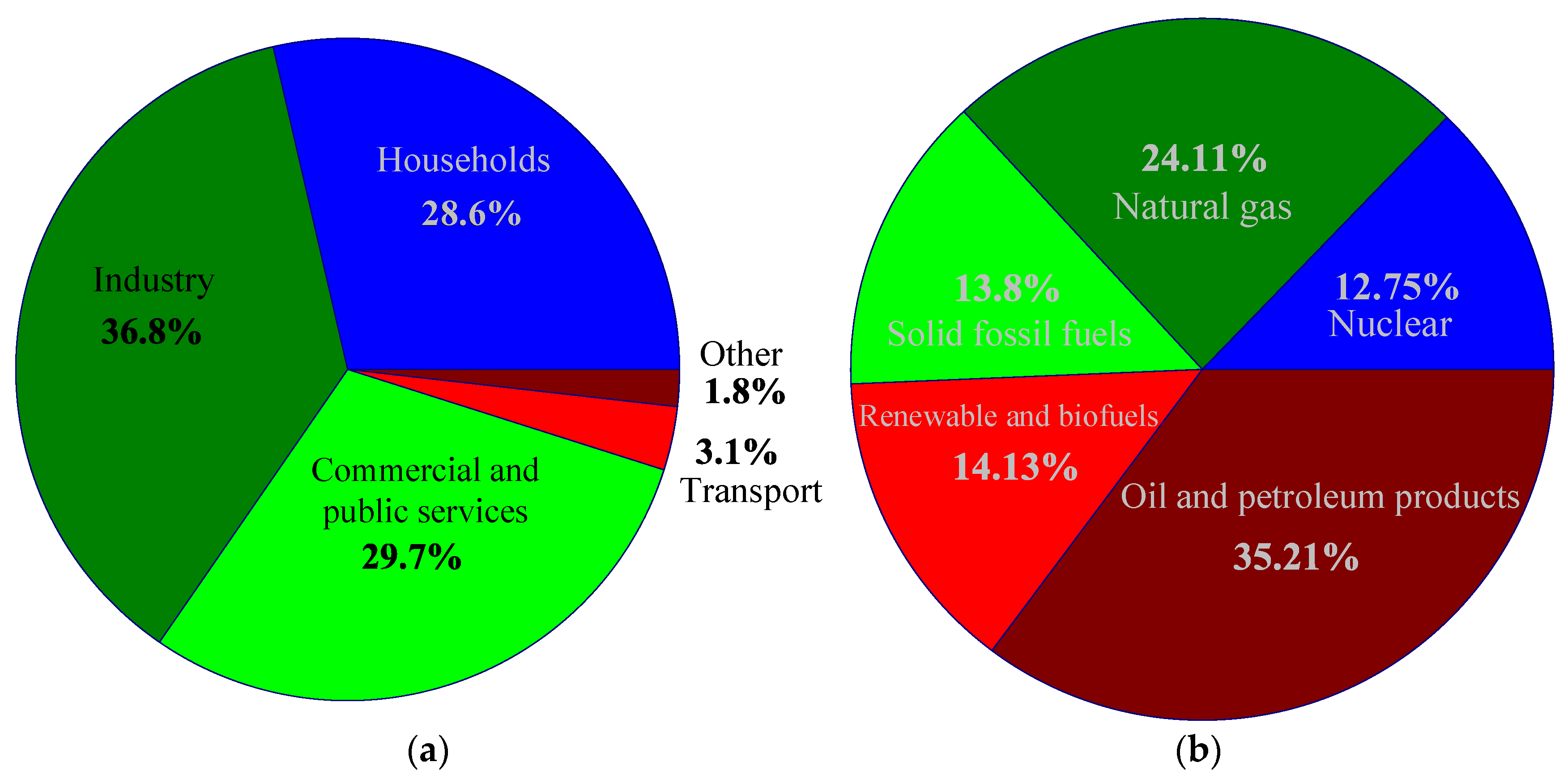

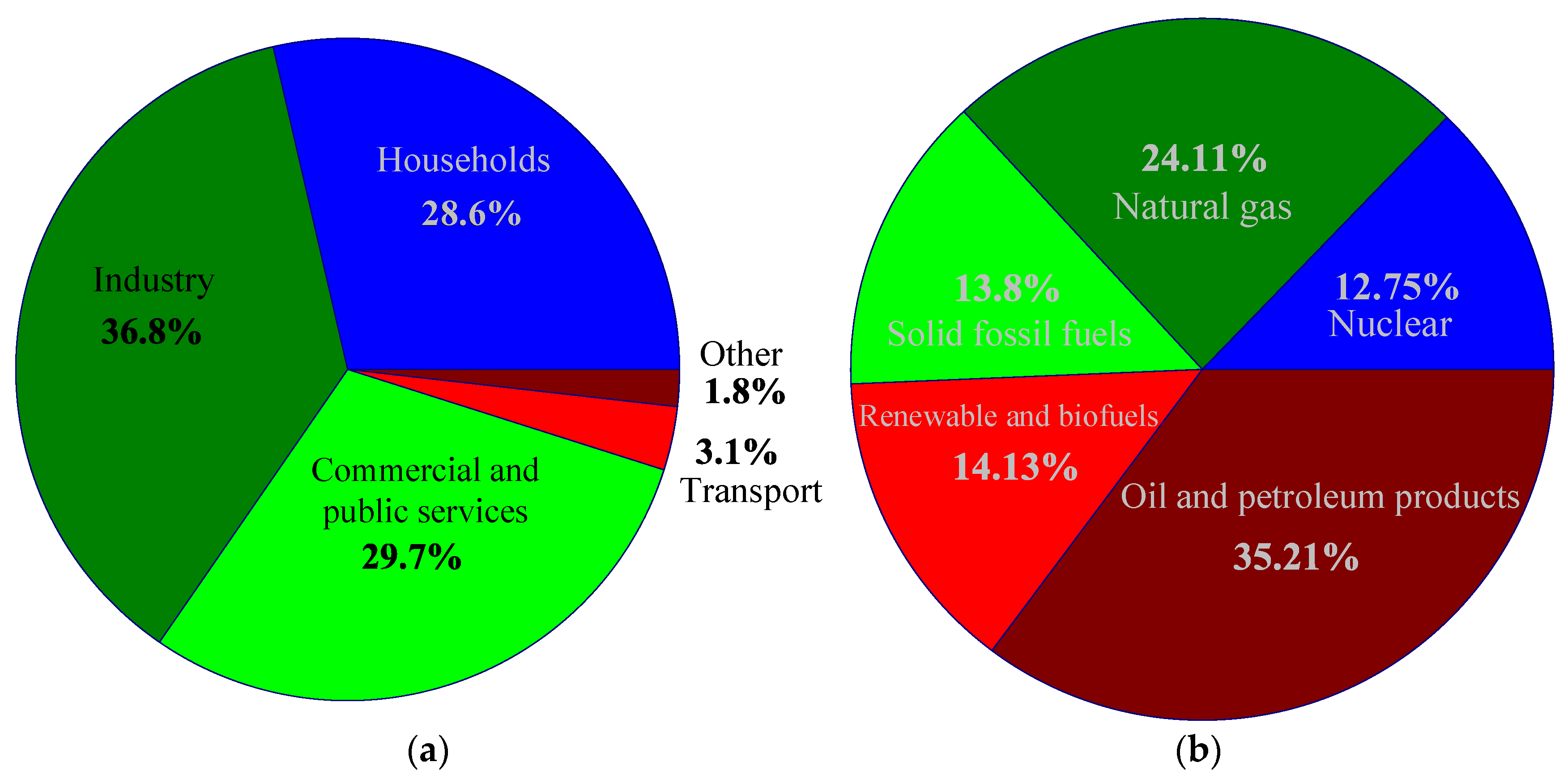

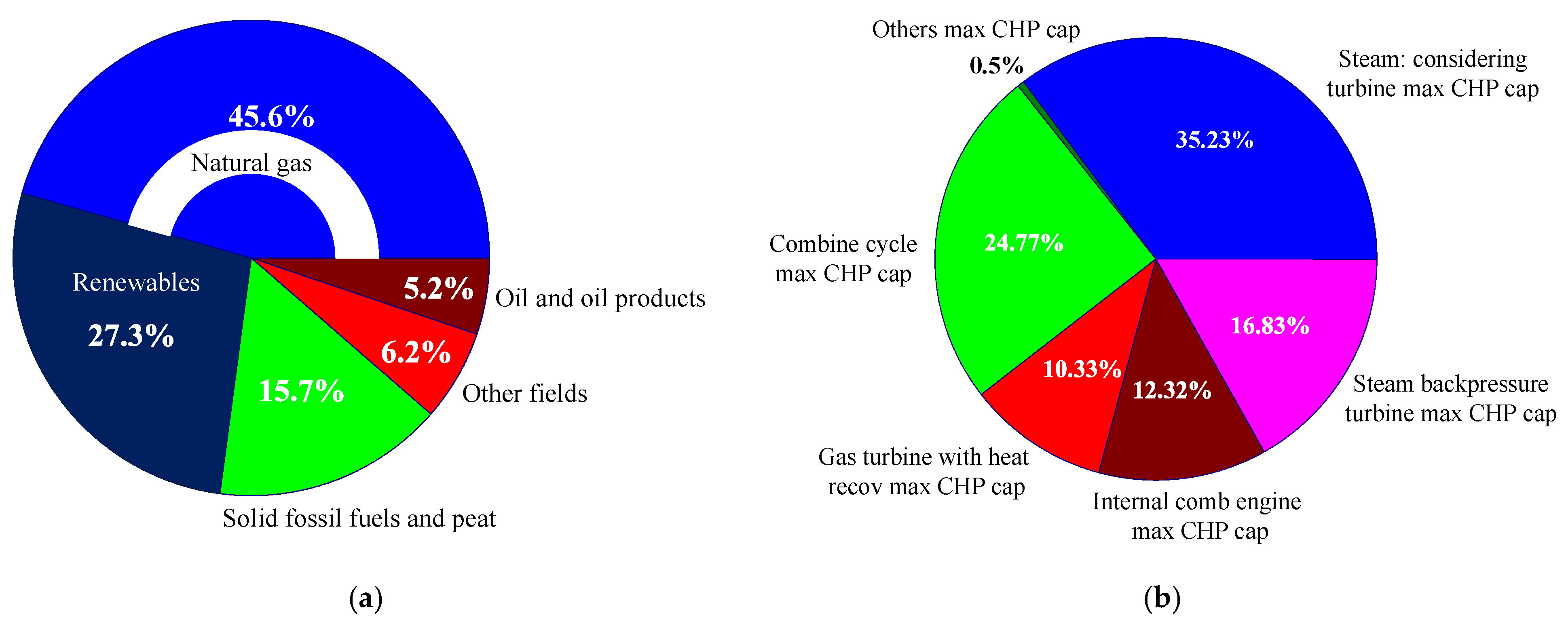

Processes Free Full Text Analyzing Utilization Of Biomass In Combined Heat And Power And Combined Cooling Heating And Power Systems Html

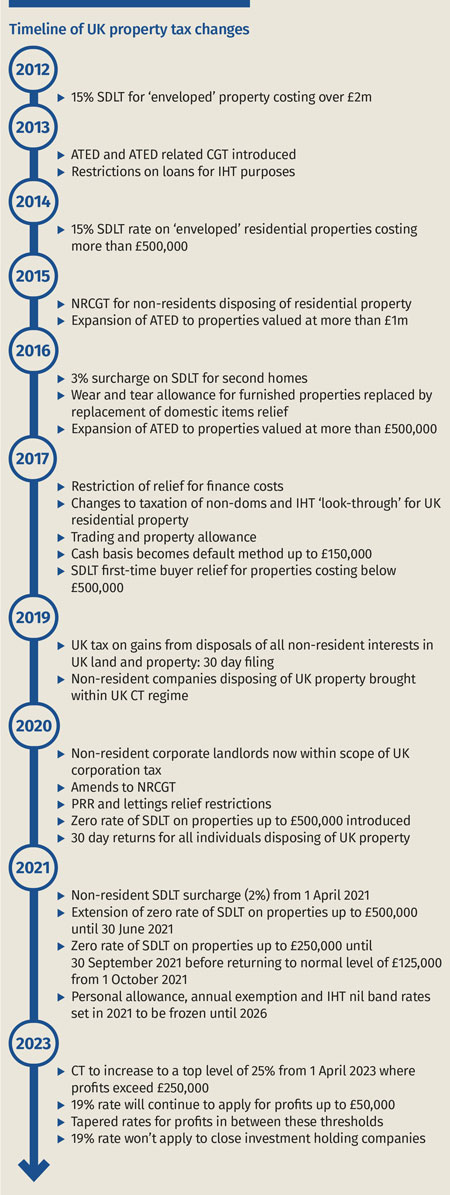

The Changing Landscape For Non Resident Corporate Landlords

Processes Free Full Text Analyzing Utilization Of Biomass In Combined Heat And Power And Combined Cooling Heating And Power Systems Html

Key Policy Insights Oecd Economic Surveys Estonia 2019 Oecd Ilibrary

Pdf Personal Income Tax And Government Revenue Evidence From Oyo State

Financial Statements Knowledge Base

Financial Statements Knowledge Base

Key Policy Insights Oecd Economic Surveys Estonia 2019 Oecd Ilibrary